Washington State Tax Guide

State tax registration guide for Washington.

Need to register taxes in another state? Review the State Tax Guide section in our Tax Services Toolkit.

REQUIRED REGISTRATIONS

-

Unemployment Insurance: Washington Employment Security Department

REQUIRED INFORMATION

-

- ESD ID # (format: XXX-XXXXXX-XX-X)

-

If you're unable to locate your Agency documentation with the exact ID #, please note the first three (3) digits may be "000".

-

-

UBI ID # (format: XXX XXX XXX)

-

Current year SUI/EAF rates.

-

PFML ID # (format: CXXXXXXXXX)

Tip:

When updating Namely Payroll, please enter the ESD ID as your EIN for Washington Unemployment Insurance, and Employment Admin Fund tax codes. Do NOT enter the UBI number as your EIN, as this will cause issues with filing and payments.

REGISTERING FOR UNEMPLOYMENT INSURANCE

The registration process begins by filing for a business license application with the state of Washington. The Department of Revenue will process your application, and notify the Employment Security Department (ESD) to open an unemployment insurance account. You'll receive a letter and a packet of information which you should retain for your records within two weeks.

The Agency documentation includes:

-

Your ESD Reference Number

-

Your State Unemployment and Employment Administration Fund rates

-

Your Unified Business Identification (UBI)

Tip:

Future-date registration is possible for this state's unemployment insurance!

Next, you'll need to update Namely Payroll within the Company > Tax (Washington Unemployment Tax, and Washington Employment Administration Fund tax codes). Your ESD Reference Number is your EIN for both tax codes, and you'll need to update the rates for each tax code.

Tip:

If you are liable for WA Paid Family and Medical Leave (PFML) you will need to set up an account within the agency.

Contact:

Call the agency at (855) 829-9243 if you need further assistance.

Standard Occupational Classification Codes

Washington State now requires employers to report Standard Occupational Classification (SOC) codes for each employee in their quarterly reports for unemployment insurance beginning with Q4 2022 wages paid from October 1 to December 31. Penalties may be assessed in the future for missing or incorrect SOC codes.

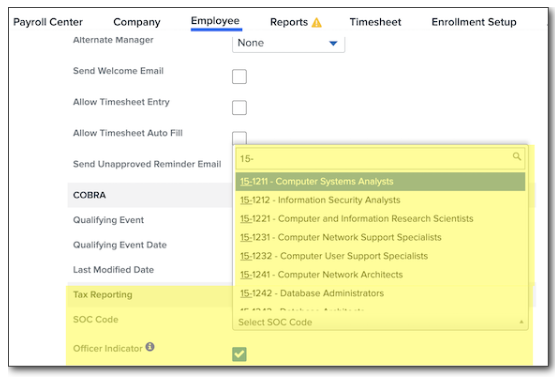

To add this information for any employee subject to WA UI:

-

Use Washington’s SOC lookup website to find the appropriate code(s) for each employee based on their role.

-

Go to Payroll > Employee > search for the employee’s Payroll profile > General.

-

You can also filter your employee list to only display employees who work in the state of Washington.

-

-

Under Tax Reporting, enter or select the correct SOC Code.

-

If you would like state-submitted reporting to indicate that the employee is a corporate officer, select the Officer Indicator field.

-

Please note: The Officer Indicator field will default to no/unchecked.

-

-

Click Save.

More detailed information is available in this article: Washington State – Quarterly SOC Reporting Requirements as well as from the Washington State Employment Security Department.

ADDITIONAL REQUIRED STATE TAXES

Paid Family Medical Leave

Beginning January 1, 2022, Washington state implemented Paid Family and Medical Leave. Employers of every size are required to collect premiums and submit reports to the state each quarter. You are also required to notify your employees about the program.

Tax ID Number: The ID number is your UBI number with a c in front of it. You would have received this ID number when you applied for your business license in Washington.

-

Employers with fifty or more employees will pay both the employer and employee portion of the tax.

-

Employers with less than fifty employees will not be liable for the employer portion of the tax but may choose to pay it.

The tax is calculated based on the current year social security wage base and current year rates that can be found in the document within this article under Additional State Tax Rates and Wage Bases.

For details on how to apply this tax, see our article How to Configure Washington Paid Family Medical Leave.

Long Term Care

Washington Long Term Care tax, which we implemented on January 11, 2022, following Governor Jay Inslee’s statement. On January 27, 2022, Governor Inslee signed two bills, HB-1732 and HB-1733, which passed the state legislature to officially delay the program’s implementation by eighteen months.

As a result, the tax code was deactivated in Namely Payroll at 7:40 PM ET on Friday, January 28th to comply with the delay. Any payrolls opened after this time will not have the tax applied. If applicable, your company will receive a refund for withheld taxes by the end of the week. If you have any individual employees who have already had the tax withheld, they must be refunded within 120 days of the bill being signed into law.

Next Steps

-

Discontinue withholding of WA Cares premiums from employee earnings.

-

Reimburse employees for withheld WA Cares premiums as soon as possible. All premiums must be refunded to employees within 120 days.

-

Continue to maintain copies of exemption approval letters for workers who’ve provided them.

Tax Details:

-

Employee Contribution: 0.58% per $100 of covered employee wages.

-

Employer Contribution: None, employee-only tax.

-

ID Format: The ID number will be the same as your Washington Paid Family Leave ID. If you already have an ID for this tax, no additional registration is required. The format is your UBI number with a "c" in front.. You would have received this ID number when you applied for your business license in Washington.

For more information on the tax, visit the WA Cares Fund.

POWER OF ATTORNEY FORMS

Please note, Namely does not require a Power of Attorney for this state at this time. It is not required to file or remit payments on your behalf. If one is needed to resolve a tax matter, the tax notice team will request one from you at that time.

If a Power of Attorney is requested from you, you should email completed copies of the forms namelyPOA@Namely.com with the CID in the subject line for processing. We will update our system and maintain a copy of each form for record-keeping purposes

For additional information on Power of Attorney, read Completing the Power of Attorney Package.

PAYROLL + TAX FACTS

Refer to this document for more information:2022-2023 Federal and State: Payroll and Tax Fact Shee